Hi there! If you’re new to investing, you’ve likely heard of stocks and mutual funds. Both are well-known investments for making your money grow, but they’re different in how they work. Selecting the right one can be confusing at first. In this article, we’ll compare the fundamental differences between stocks and mutual funds in easy-to-understand terms. We’ll also discuss which one may be best if you’re just starting.

What Are Stocks?

Stocks are similar to bits of a company. If you purchase a stock, you’re an owner of a small portion of the company. Suppose you purchase Apple stock. You are now a shareholder of Apple. The price of your stock increases or decreases depending on how successful the company is.

Stock investing involves you selecting the companies for yourself. You trade them on stock exchanges such as the New York Stock Exchange. The idea? Buy low and sell high and profit. But stocks are volatile because a negative news story on a company can make its price plummet quickly.

Pros of Investing in Stocks

- High potential returns: If the company grows, your money can grow a lot.

- Control: You decide which stocks to buy and when to sell.

- Dividends: Some companies pay you a share of their profits.

Cons of Investing in Stocks

- High risk: Prices can change quickly, and you could lose money.

- Needs research: You have to study companies, which takes time.

- Emotional stress: Watching daily ups and downs can be nerve-wracking.

Also Read: Top 10 Mutual Fund Investment Apps in India in 2025

What Are Mutual Funds?

Mutual funds are a team effort. A bunch of individuals (investors) collect money in common. Then, a professional manager invests that money in a combination of stocks, bonds, or some other investments. It is not about having one company – it is about diversifying your money into dozens.

For example, a mutual fund can invest in 50 companies. So if one of them performs badly, the others will counteract it. You purchase “units” of the fund, and its price fluctuates according to the overall performance of all its investments.

Pros of Investing in Mutual Funds

- Diversification: Your money is spread out, reducing risk.

- Expert help: A fund manager makes the decisions for you.

- Easy to start: Great for beginners with small amounts of money.

Cons of Investing in Mutual Funds

- Fees: Managers charge for their services, which can eat into profits.

- Less control: You don’t pick the investments yourself.

- Slower growth: Returns might not be as high as picking a winning stock.

Also Read: SIP (Systematic Investment Plan) vs Lump Sum Investment – Which is Better for You?

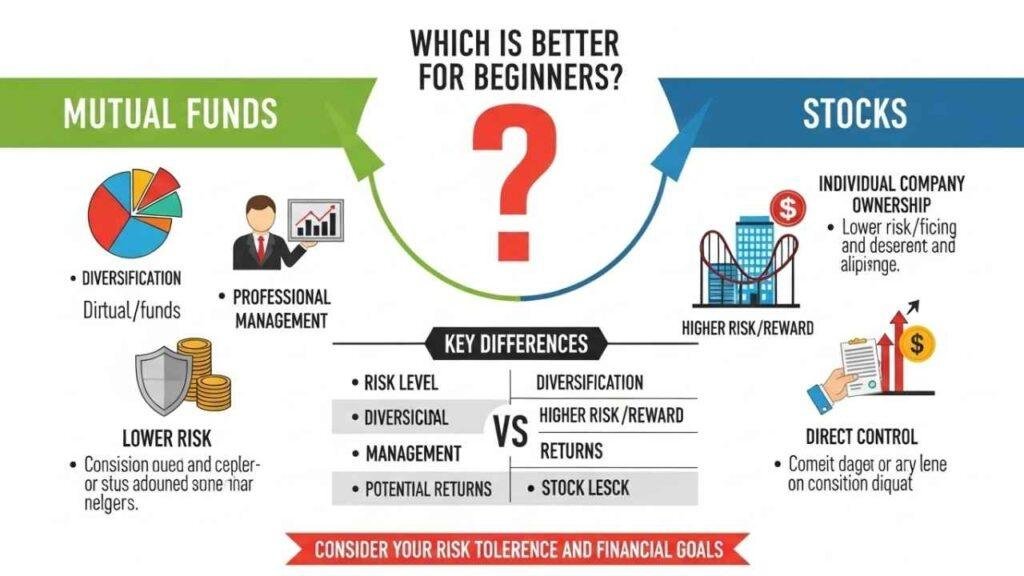

Key Differences Between Mutual Funds and Stocks

Now that we know the basics, let’s compare them side by side. This will help you see how they stack up.

- Ownership: With stocks, you own part of a single company. Mutual funds let you own a slice of many investments.

- Risk Level: Stocks are riskier because they’re tied to one company’s fate. Mutual funds lower risk through diversification.

- Management: Stocks require you to manage everything. Mutual funds have pros handling it.

- Cost to Start: You can buy one stock if it’s cheap, but mutual funds often have minimum investments (though many are low now).

- Time Needed: Stocks demand constant watching and research. Mutual funds are more “set it and forget it.”

- Returns: Stocks can give big wins (or losses) quickly. Mutual funds aim for steady, long-term growth.

In other words, stocks are similar to speeding in a sports car – thrilling but risky if you’re inexperienced. Mutual funds are similar to riding a bus – safer and piloted by a pro.

Which is Better for Beginners?

If you’re a novice, mutual funds are most likely the better option. Why? Investing is tricky business, and errors cost you money. Mutual funds provide you with in-house assistance from professionals and diversify your risk. You don’t have to become a stock-picking genius overnight.

Having said that, stocks can be a blast if you like reading about companies. Begin small and apply apps that simplify it. But for most beginners, starting with mutual funds helps gain confidence. When you’re ready, you can experiment with stocks also.

A good advice: Consider your objectives. If you are looking for quick money, stocks may lure you (but know the risks). For long-term saving, such as retirement, mutual funds are the way to go.

Read More: Mutual Funds vs. Chit Funds: Which is Better for You?

Final Thoughts

Both mutual funds and stocks have their role in investing. The difference boils down to risk vs. convenience. For a beginner, mutual funds provide an easier initiation with diversification and professional advice. Keep in mind, there’s no such thing as a risk-free investment – always research it first or consult a financial advisor.

What’s your opinion? Stocks or mutual funds? Let us know in the comments below. If you’re ready to dive deeper, see what else we have to say about investing for beginners.

Disclaimer: This is not investment advice. Investing carries risks, and previous performance is not necessarily indicative of future results.